There are six years remaining in the car’s total useful life, thus the estimated price of the car should be around $60,000. Each year, the depreciation expense is $10,000 and four years have passed, so the accumulated depreciation to date is $40,000. The majority of companies assume the residual turbotax super bowl commercial tv ad 2021 and #taxfacts value of an asset at the end of its useful life is zero, which maximizes the depreciation expense (and tax benefits). If the residual value assumption is set as zero, then the depreciation expense each year will be higher, and the tax benefits from depreciation will be fully maximized.

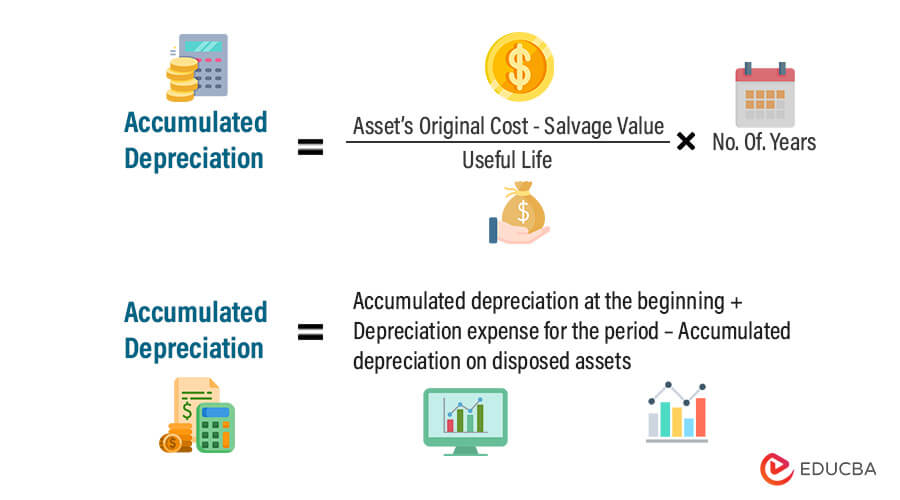

Straight-Line Depreciation

If the salvage value is greater than the book value then income added after deducting the tax, the value/ amount then left is called after-tax salvage value. The after tax salvage value online calculator provides us the after-tax value of the salvage of the asset. The applicable tax rate on the gain from the asset sale significantly impacts the after-tax salvage value. If the market is saturated with similar assets, the salvage value may be lower due to decreased demand.

How to Use the Salvage Value Calculator

- The buyer will want to pay the lowest possible price for the company and will claim higher depreciation of the seller’s assets than the seller would.

- You’re faced with the decision of whether to sell it or keep it until it becomes obsolete.

- Residual value and resale value are two terms that are often used when discussing car-purchasing and leasing terms.

- Companies determine the estimated after tax salvage value for anything valuable they plan to write off as losing value (depreciation) over time.

It helps businesses and individuals estimate the net cash flow they will receive when disposing of an asset after taking into account the applicable tax consequences. In this article, we’ll walk you through the process of calculating the after tax salvage value. This method assumes that the salvage value is a percentage of the asset’s original cost. To calculate the salvage value using this method, multiply the asset’s original cost by the salvage value percentage. It includes equal depreciation expenses each year throughout the entire useful life until the entire asset is depreciated to its salvage value.

Straight Line Depreciation Calculator

If a company expects that an asset will contribute to revenue for a long period of time, it will have a long, useful life. From this, we know that a salvage value is used for determining the value of a good, machinery, or even a company. It is beneficial to the investors who can then use it to assess the right price of a good. Similarly, organizations use it to examine and deduct their yearly tax payments.

How To Calculate an Asset’s Salvage Value

If the same crane initially cost the company $50,000, then the total amount depreciated over its useful life is $45,000. Salvage value is the estimated value of an asset at the end of its useful life. It represents the amount that a company could sell the asset for after it has been fully depreciated. On the other hand, book value is the value of an asset as it appears on a company’s balance sheet. It is calculated by subtracting accumulated depreciation from the asset’s original cost.

Depreciation Methods for Valuing Assets Over Time

Hire an appraiser to determine the asset’s fair market value at the end of its life. Simply input the necessary information, and they’ll provide you with an estimated value. This is the amount you could get for the asset if you were to sell it for scrap or parts at the end of its useful life.

Besides, the companies also need to ensure that the goods generated are economical from the customer’s perspective as well. Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market. Let’s calculate the salvage value of a laptop with an expected useful life of 5 years, a current market value of $1,000, and a depreciation rate of 20%. When an asset or a good is sold off, its selling price is the salvage value if tax is not deducted then this is called the before tax salvage value. The balance sheet shows the net book value of an asset, which is the original cost minus accumulated depreciation, helping stakeholders understand the asset’s current worth.

You can find the asset’s original price if the salvage price and the depreciation rate are known to you with the salvage calculator. The car salvage value calculator is going to find the salvage value of the car on the basis of the yearly depreciation value. Enter the original value, depreciation rate, and age of asset in tool to calculate the salvage value.

It equals total depreciation ($45,000) divided by useful life (15 years), or $3,000 per year. This is the most the company can claim as depreciation for tax and sale purposes. Have your business accountant or bookkeeper select a depreciation method that makes the most sense for your allowable yearly deductions and most accurate salvage values. If your business owns any equipment, vehicles, tools, hardware, buildings, or machinery—those are all depreciable assets that sell for salvage value to recover cost and save money on taxes. Any calculation of net present value is incomplete if we ignore the income tax implications of the project.

Scrivi un commento