I just want to see a list of the adjustments if possible. These adjustments will form the basis of the next step in the process — actually adjusting the payroll liabilities in QuickBooks Online. This process necessitates a thorough review of the current payroll settings to identify areas that require modification. For example, if there are changes in tax laws, the tax categories must be adjusted accordingly to ensure compliance. QuickBooks offers options to customize withholding rates based on the latest regulations, and it also allows flexibility in adjusting employer contributions. It is crucial to consider the implications of these changes, as they may affect employee pay, tax reporting, and overall financial management.

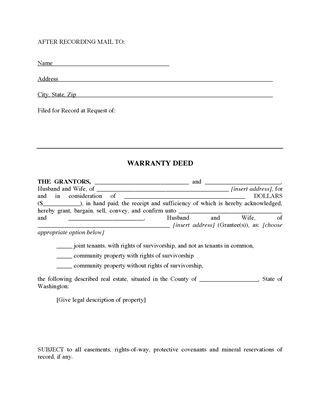

Option 2: Adjusting Liabilities Through the Chart of Accounts

Employee adjustments are used to change an employee’s year-to-date information. Once done, you can run the payroll summary report again to verify the changes. The payroll interface has suddenly changed (some searching suggests this is due to a forced update to ‘Core Payroll’. When running payroll, there is now a mandatory field labelled “Chart of account”. The option to perform a one-time charge for Social Security and Medicare is unavailable on QuickBooks Desktop.

Reasons To Use Payroll Liability Adjustment

Unfortunately, it is the only way to post the correct amount into the bank account. Therefore, using QBO payroll has become more complicated, and I am considering moving all of my clients away from it.This doesn’t make sense, and this is something we have been able to do with QuickBooks desktop. As accounting professionals, actual home office expenses vs the simplified method we should be able to adjust amounts due. I am starting to think that QuickBooks online is not a solution. Once the discrepancies are reconciled, the adjusted payroll liabilities and tax amounts can be accurately entered into QuickBooks Online, ensuring that the financial records reflect the updated information.

Step 2: Adjust your payroll liabilities

She is currently working as a cloud hosting consultant with Asquare Cloud Hosting. She loves to read and write about the latest technologies such as cloud computing, AI, DaaS, small businesses, manufacturing. When not writing, she is either reading novels or is indulged in a debate with movie fanatics. Sadly, I cannot see your screen shot (don’t know if it’s my computer or QBO keeping us from seeing it), but I appreciate your insight. It is so frustrating that QBO has tied the hands of the accountants who should be able to adjust these things.

Option 1: Adjusting Liabilities Through the Payroll Center

Should use worksheet for Line 10 to calculate FUTA tax liability for exempt corporate officer after each payroll and adjust FUTA tax liability as soon as credit for exempt officer. Therefore it overstate tax liability for small businesses pushing to pay taxes even it is not necessary.. Maybe, it will be reasonable to let users determine tax rate for FUTA as it is designed in desktop version. I don’t understand why payroll liability adjustments aren’t an option in QBO but are on desktop. This article also explains how to use a liability adjustment to correct an employee’s year-to-date information contained in payroll items, such as company contributions, employee addition, and deduction payroll items. If you want to correct your employees’ liabilities before their next paycheck, then you can create a liability adjustment.

How can Taxfyle help?

Automate the payroll process so you can save time and focus on growing your business. Use payroll software to generate a payroll-liability balance report each time you process payroll. Review the report, so you can post each adjusted journal entry. This will help you view useful information about your business, payroll taxes, and employees. The tax payment is split based on the total withholding for all employees, and the total employer match. Again you write a check in QuickBooks Online with the split between the payroll liabilities and employer taxes, and everything should reconcile.

Set your business up for success with our free small business tax calculator. Topical articles and news from top pros and Intuit product experts. You can always come back to the community for other program concerns. I can definitely see how this problem may have inconvenienced you a lot.

How these are calculated depends on the federal tax rates. Regarding correcting for the closed period, I would suggest consulting with an accountant so they can provide other options to ensure your books are updated. Luckily, you don’t have to handle the search on your own. By integrating Taxfyle with QuickBooks and leveraging its industry-specific tools, you can stay organized, manage multiple projects, and focus on growing your business.

Also, the software calculate workers compensation insurance for part-time salary employees as they work full-time even it clearly showing specific amount of hours worked per week. It is ridiculous that payroll taxes cannot be adjusted in the online but you can in desktop. The state adjusted the unemployment tax in the middle of the quarter so the taxes due were lower than what is in Quickbooks. Now it is telling me I am late, I will owe penalties and I cannot adjust it.

The accrual method records payroll expenses in the month they are incurred, regardless of when the expenses are paid in cash. The matching concept presents a more accurate picture of company profit. When you submit payments, you also provide reports that explain the purpose of the payments (employee name, amounts withheld, etc.). Your company’s payroll- liabilities chart of accounts may include dozens of balance-sheet account numbers. By following this method, you can conveniently adjust payroll liabilities within the Payroll Center, eliminating the need to navigate through multiple menus or accounts.

No business should use the cash method because the method presents a distorted view of company profit. When payroll is processed on April 5, cash is reduced by $3,000 and wages payable is decreased by $3,000. The expense was posted in March when the restaurant employees worked the hours. Revenue in March is matched with March expenses, including the $3,000 in payroll how to estimate burden costs. On the other hand, you need to contact our technical support team for further assistance if you need to complete an adjustment for a previously filed tax form or payment and you’re using QuickBooks Desktop Payroll Assisted. It is impossible to adjust overpaid payroll liabilities in these versions by users themselves and thus requires an expert to fix it.

This involves carefully updating each employee’s hours, wage rates, and any other relevant information in their respective payroll profiles. After making these individual adjustments, it’s essential to reconcile the payroll records with the amounts owed to avoid any discrepancies. In this comprehensive guide, we will explore how to adjust payroll liabilities in QuickBooks, QuickBooks Online, and QuickBooks Desktop. From identifying the need for adjustment to making necessary changes in payroll setup and reconciling liabilities, we will cover the essential steps and best practices for each scenario. While they worked on fixing FUTA taxation (I commented few months ago), they screwed up state unemployment putting few employees as exempt form the state tax.

Therefore, you don’t need to make any changes to charge these taxes. You’ll have to ensure this is linked to the liability account. In QuickBooks Payroll, free bookkeeping templates customize your own pdf and print for free you can set up pre-tax or after-tax deduction items. If you aren’t sure how the deduction is taxed, talk to your plan administrator or an accountant.

- I’m here to share insights about payroll tax calculations in QuickBooks Desktop Payroll.

- If you’re still having issues with these liabilities after trying the recommendations from my colleague, then I suggest contacting our Customer Support Team.

- When you record the paychecks in the Payroll Clearing account, you still book the gross pay and the withholding.

- The expense was posted in March when the restaurant employees worked the hours.

Which method you choose will depend on how much detail you want in your payroll reports within QuickBooks Online. Before we get into the two methods, you need to understand the basics, as well as the most common mistakes inexperienced bookkeepers make while entering payroll. Once this is completed, the adjusted figures need to be accurately entered into the payroll system to ensure that all liabilities are properly accounted for and reflect the changes that have been made. I have a similar issue I show a positive balance I do need to adjust it.

This meticulous process helps maintain accurate and compliant payroll records for the organization. I had wasted another three hours with tech support on the phone. Now it is the time to file payroll quarterly reports and QBO pulled correct tax form for WA WC filing; at the same time the pay amount is substantially higher than actual tax liability. It happened partially due to improper tax rate settings at the beginning of the year and, also, due improper tax calculations for part-time salary employee. In addition, QBO pulled from nowhere some over payment of taxes from 1st quarter 2021. He helped to submit payroll correction form for last quarter, that supposed to be completed within the next days (according to email I received).

Scrivi un commento