Need to remortgage loans Eckley CO a home that you do not actually have home financing towards the? Discover how far collateral you could potentially launch & in the options for more 60s otherwise people who have poor credit.

How can i Remortgage a property I Own Outright?

Remortgaging a property you already very own performs inside mostly brand new same way due to the fact remortgaging any assets. When you’ve made the selection, get in touch with a specialist advisers. Our brokers possess a bigger listing of financial also offers which you have access to rather than going lead to help you a lender or Building Area.

After you have received in touch with an adviser and they will have weighed upwards your choice, they’re going to evaluate the job predicated on their qualifications and you can cost conditions. And here the borrowed funds bank often imagine just how much your must borrow, the worth of your home, your earnings, any latest financing or debts you have got and your ability to pay back the loan. As part of you happen to be elevating capital on your property the lending company will require you what you’re planning to do on the currency. This might be refurbishing your property otherwise to invest in an extra possessions.

Just how much Should i Remortgage a house I Individual To own?

Although it mainly hinges on the financial institution, the best mortgage-to-really worth typically offered when remortgaging a house your currently individual try 80%. So it equates to ?80,000 per ?100,000 of the property’s really worth. However, the most you might obtain will always believe the earnings and you can things. Hence, it is preferable to inquire of the financial institution about it just before making an application for the borrowed funds.

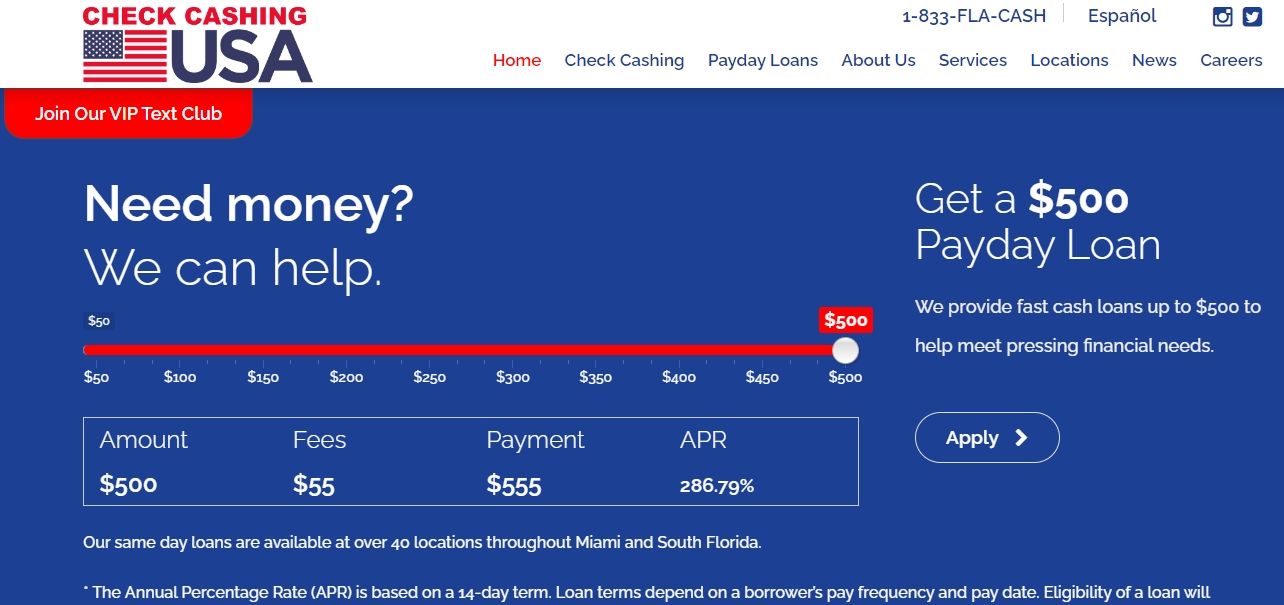

Are Our very own Borrowing from the bank Calculator

Our very own Simply how much Do i need to Use? Calculator uses your revenue to sort out the most your might obtain. Give it a try!

Try Remortgaging Unlike Equity Launch?

Taking out fully home financing towards property you own outright is actually not the same as guarantee release. That have good remortgage, you have to make monthly premiums till the prevent of your own identity. Having collateral release, this new debtor can pick to spend the attention to your a monthly foundation otherwise allow the interest roll up and you may shell out they and you can the mortgage when the home is sold just after the demise. There are also more eligibility criteria, most notably in terms of years limits. An equity launch product is only available to residents old more 55. A great remortgage needs you to generate month-to-month payments, however, guarantee launch will bring a lump sum payment otherwise an effective drawdown business.

Should i Remortgage Whenever I am Resigned or higher 60?

Remortgaging your residence after you turn 60 would be challenging. The cause of so it, would be the fact loan providers uses retirement income whenever assessing their affordability, so you is not able in order to acquire to after you was indeed operating. Even though some tend to give in order to older people, it’s going to score much more difficult to remortgage once you get to 65 and over. If you find yourself now resigned without typical income, you will probably find you can not rating home financing whatsoever. Within this condition, guarantee launch can be a choice.

Talk to one of the professional home loan advisers during the John Charcol to find out and therefore loan providers are probably to adopt mortgage programs regarding seniors.

E mail us

For those who own your residence downright and wish to obtain it mortgaged, it is not always easy to know hence mortgage device is correct to you personally. But that is in which we could let. At the John Charcol, all of us from educated, independent advisors is here now so you can find the best financial unit for the private items. To find out more, contact us on the 0330 433 2927 or inquire on the web.

Scrivi un commento