- Draw since the The brand new

- Store

- Subscribe

- Mute

- Subscribe to Rss feed

- Permalink

- Report Poor Blogs

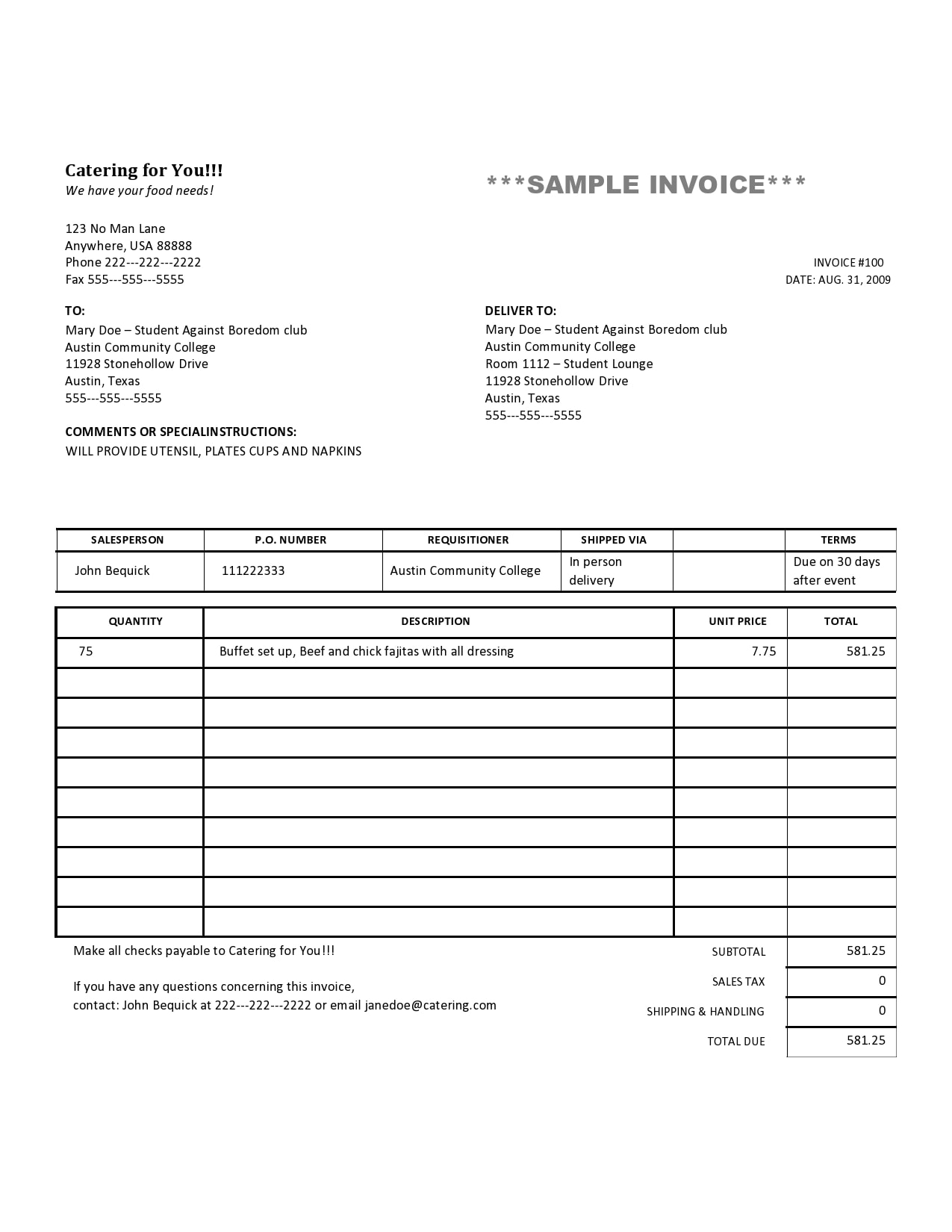

Financing ConditionsThe financing criteria, certain so you’re able to activities needed to file the loan software, are as follows

Very first time acquiring home financing and that i envision I will possess discover right here very first. I just applied that have NFCU and you can acquired quick pre recognition. To purchase $700,000 home with $400,000 off. Annual salary are $205k and thirty-five% incentive. I am not using with my husband because the he has got no money possesses a home loan within his identity simply (we live-in MO). I display combined financial and that i possess personal bank also. I simply don’t need your into the mortgage, my financial ratings was mid so you’re able to higher 600’s no lates earlier in the day 2 years no series, merely carry particular credit card debt.

$26,000 during the personal credit card debt (24% total application). Prior to applying for the borrowed funds, I grabbed aside a consumer loan regarding Sofi so you’re able to consolidate credit card financial obligation to your a lowered rate of interest (such as for instance fifty% down price) thus i you will definitely shell out everything regarding in two years. Couple pay it off today however, must keep money in my lender so i have exchangeability. Brand new sofi financing isn’t really to my credit file yet , due to time of these and you will mortgage software, I seriously dont recall easily disclosed it as a loans into the software that have NFCU whenever i just adopted the mortgage and had not also generated a payment yet ,, alternatively We listed my personal credit debt. We paid off my $26k credit card debt and you may instead possess a good $22k loan, however, my bank card $0 balance failed to article in advance of NFCU went my borrowing. Once more – time. And bc my better half isn’t toward financing along with his mortgage isn’t within my term it’s not to my credit history and not an obligations that i are obligated to pay.

All that said, I experienced pre-approval immediately after implementing, (5.75% 5/5 Sleeve), locked regarding the price and you can had conditional approval two days immediately following publishing most of the my files (offer, W2;s, financial statements, spend stubs and report which i alive rent-free and you will page which i can work secluded). Now I’ve a loan processor and you may starting UW – here are this new 18 standards. I bolded those I don’t know. Can people indicates?

In addition to the joint account We share with my better half will teach a great $600 percentage to your bank that is not a personal debt one We detailed because it’s not mine or perhaps in my personal name. Often so it getting anything UW asks myself throughout the otherwise as my borrowing from the bank currently approved and it is not a loan position, it is a non procedure?

Exact same loans I experienced when credit acknowledged to own mortgage just consolidated they to help you a lower life expectancy rate of interest and so i pays they out of reduced.

Whatever else I ought to be concerned about? Everyone loves my LO this woman is already been towards the top of what you and you may very receptive thus want to simply build one to name and just have all requirements because I will – everything you perhaps not into the bold looks basic posts in my experience in the event no sellar concessions toward deal submitted therefore undecided in which that comes from. And i considering th4 bank report guaranteeing $400k 2 times so unsure how else to verify they.

Whenever we dont found the requested documents because of the , we shall, unfortunately, be unable to done idea of the credit request.

I must suggest the fresh concerns (Sofi loan) and you can curious in the event the my personal reason above makes sense?

Restriction resource may possibly not be available on every tactics. That it mortgage recognition page stands for Navy Federal’s financing recognition just and is not a guarantee regarding recognition from the an exclusive Financial Insurance policies Company. In addition, it includes any agent otherwise broker credit listed on the sales contract. Susceptible to change in the event the present finance are being utilized. Provider concessions to not go beyond:ten Ratified conversion process package with all of addendums/attachments (the place to find be obtained). Financing is even subject to plan and procedural changes. All borrowing data files have to be just about four months old on mention go out. Relate to the brand new Offering Guide having guidance on age brand new assessment or assets examination declaration. When your deposit can be used and come up with any area of the borrower’s lowest share that has to are from their unique money, the source from financing on the deposit should be affirmed.

To exercise the significance invited (appraisal waiver) render with signal and you will guarantee save to the worth, status, and you can marketability of your topic possessions, the mortgage birth file need to are the Casefile ID and you can Unique Feature Code 801. If the value greet (appraisal waiver) bring isnt exercised, an appraisal is needed for it deal in addition to mortgage don’t become sold with Special Element Password 801. Remember that DU doesn’t identify all worthy of allowed (assessment waiver) ineligible transactions, together with Tx Part fifty(a)(6) mortgages; usually refer to the legitimate registration loan fresh new Promoting Self-help guide to guarantee qualifications. Consider the latest Offering Guide for more information. If your query resulted in the newest obligations, bring paperwork of conditions.

Scrivi un commento