A beneficial USDA Financing – also referred to as an outlying Invention (RD) Financing – is an excellent selection for men and women seeking accept into the particular rural and suburban locations.

In the DSLD Financial, our very own knowledgeable Financing Officers will explain the advantages of this form off loan and you can direct you through the USDA Mortgage certification processes.

Discuss Mortgage Choice

Speak to a loan Administrator understand which kind of mortgage best suits your circumstances. We can usually pre-meet the requirements you in less than 24 hours.

What exactly is an excellent USDA Mortgage?

A USDA Loan – otherwise RD Loan – is a type of mortgage loan provided by the usa Department away from Farming. Its made to assist group inside the outlying and some suburban components buy home no down-payment, giving 100% funding in order to eligible customers.

USDA Loans make an effort to bring homeownership within the less densely populated groups and are generally ideal for those people meeting brand new program’s income and you can location criteria.

Exactly who qualifies having good USDA Financing?

Certification to have a USDA Financing is dependant on multiple factors, including income, credit history, and you will assets area. Essentially, individuals must:

- See earnings qualification, and this may differ by the part and you can house size. Income constraints are designed to guarantee the system serves those who really want to buy.

- Have a credit score away from 640 or higher to have automated acceptance, regardless if down ratings can be sensed with an increase of underwriting.

- Buy a property within the a place appointed while the qualified because of the USDA – typically rural parts and some suburban areas.

Preciselywhat are USDA Loan criteria?

- Income Qualification : Your income should not surpass 115% of one’s average house income with the urban area, modified to own relatives dimensions.

- Possessions Qualification : The home need to be situated in a location designated because the outlying by the USDA.

- No. 1 Quarters : The newest bought assets is employed since the client’s no. 1 home.

- Citizenship : Candidates must be Us citizens, All of us non-resident nationals, otherwise Certified Aliens.

- Credit history : The very least credit rating out-of 640 is preferred, but exceptions can be made to own individuals that have solid borrowing from the bank histories.

What are the money constraints to possess USDA Financing?

Money ceilings on the USDA mortgage program have decided from the location of the assets and size of your family members. So you’re able to qualify, your typically must slide for the low-to-moderate money class when you build your USDA Application for the loan.

Such constraints can vary out-of 80% to 115% of a keen area’s average family money, having differences based on factors for example nearest and dearest size. This new USDA loan was designed to serve people that you will come across almost every other financing possibilities unrealistic on account of earnings restrictions.

When you find yourself questioning if or not your see these criteria, request an effective callback and you will talk with us before you apply to own a USDA Loan online. We’re going to show you through the facts designed into the problem.

What credit history is required getting Rural Innovation Funds?

Credit rating standards getting USDA Fund may vary. While many lenders like a rating out of 640 or even more, the fresh USDA Mortgage program is acknowledged for their flexibility. Regardless if their score are lower than that it tolerance, there are recognition paths, particularly when other areas of your financial profile are good.

A strong credit rating on the 720+ diversity most definitely will increase financing conditions. Whenever you are unsure regarding your credit standing otherwise must discuss your options, talk to our Mortgage Officials to have individualized information.

Exactly what are the assets criteria getting USDA mortgage loans?

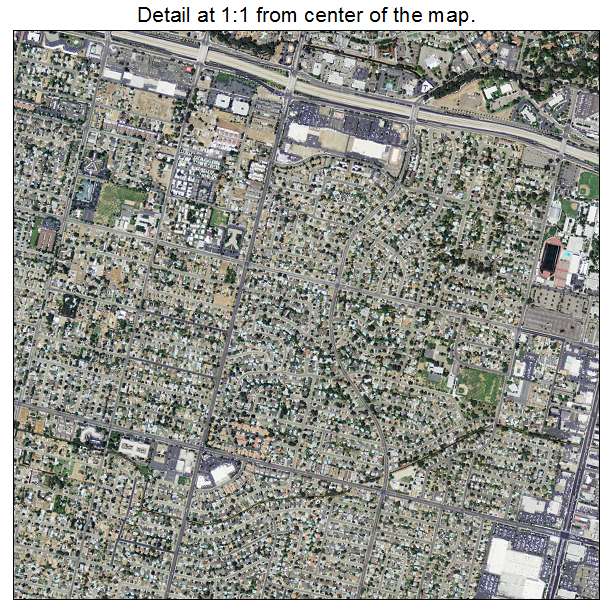

In order to qualify for an outlying house advancement financing, a house have $255 payday loans online same day Virginia to be based in good USDA-designated outlying area – usually unlock country side and you will metropolises having communities under thirty-five,000 owners.

The USDA Loan program will service homeownership from inside the smaller densely inhabited parts, promoting neighborhood development and growth. Get in touch with all of us if you have set your own landscapes with the property and are generally unsure whether it meets these standards. We are going to help make sure should your fantasy domestic suits USDA Loan standards.

Just what costs have USDA funds?

The new USDA Mortgage has one or two primary costs: a-1% upfront be certain that fee owed in the closing and you can a yearly 0.35% home loan insurance percentage, that is element of your payment per month.

not, consider this type of charges resistant to the high advantages of USDA Finance, such as for example competitive interest levels together with odds of no off commission, is essential. For those who have questions regarding the and therefore financing kind of is the best to you personally, a Mortgage Officials is happy to help you.

On DSLD Home loan, we are not no more than finance. The audience is on the turning your own fantasies towards reality. With irresistible pricing, minimal initial can cost you, and you can support for various monetary experiences, your way to a dream residence is crisper than ever.

Don’t allow things hold your right back. Utilize the field of options having a beneficial USDA Loan application-in which flexibility match cost.

Scrivi un commento