For most veterans, its amount of time in uniform triggered a severe provider-linked impairment. So it drastically impacts their life immediately following transition outside of the armed forces.

To own 100-per cent services-handicapped pros who’ve beginner personal debt, the Department of Degree has the benefit of an important advantage to enable them to end monetary worry the opportunity to keeps their loans released (forgiven). Less than federal laws, experts can also be look for government student loan forgiveness whenever they discovered an effective 100 per cent handicap get because of the Service from Veterans Points (VA). Personal beginner loan providers aren’t required to give that it benefit, many perform on a situation-by-circumstances foundation, so make sure you ask.

I remind all of the customers to check on the credit history daily, however, we want to particularly remind experts which use this benefit to be sure you to definitely their education loan servicer (the company that accumulates repayments) is providing best facts about the financing launch so you’re able to credit reporting agencies (the companies one attain market credit file).

We’re concerned one to, in a few circumstances, when veterans have the ability to discharge their student education loans because of the disability, they many years to their credit report when the the education loan servicer brings incorrect pointers with the credit reporting agencies. Such errors, when the uncorrected, can result in an awful entryway on their credit file you to makes it harder and a lot more expensive of these disabled pros so you’re able to score credit, pick an automible and take away a home loan.

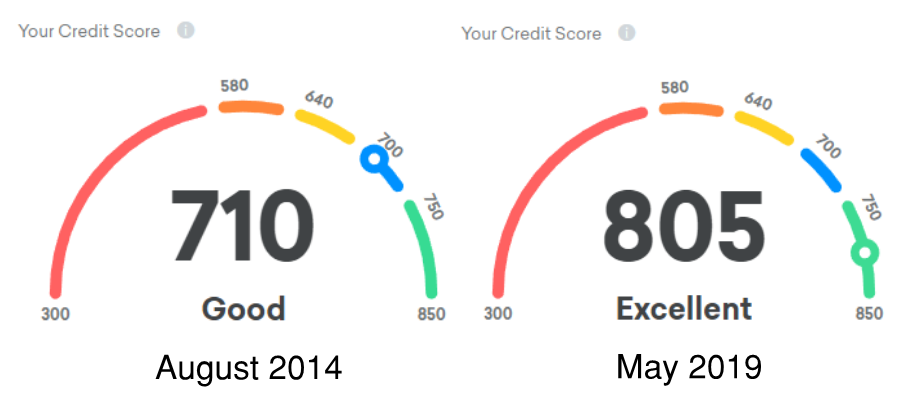

Particularly, one services-handicapped seasoned recorded a criticism to help you all of us discussing how their borrowing score dropped by 150 situations because of this type of of error. His get ran out-of a very nearly primary extremely perfect credit score so you can a reduced score simply because the guy received loan forgiveness.

I can’t rating someone to hear me personally! I am an excellent 100 % disabled Experienced that had their credit history damaged from the a cracked credit reporting system. I had my student education loans…released…during the …I ran out-of 800 so you’re able to 650 within just 2 months. I’m attacking in order to survive since the a family of personal nation are eliminating me.

Individuals are hurt when organizations furnish wrong recommendations so you can credit scoring organizations. A blunder inside a credit file can make a distinction when you look at the if or not people gets that loan, qualifies to own a low interest, if you don’t becomes offered work. These types of credit-reporting troubles, if uncorrected, can be harm pros in this instance for decades.

Particularly, here is what might happen in the event that a veteran made an effort to pick an excellent home immediately following a credit reporting error caused similar harm to their own credit character and rating which damage went uncorrected. When the she made use of a great Va mortgage to invest in a good $216,000 family, she you’ll shell out more than $forty-five,000 from inside the more desire charges along side longevity of their own financial (according to the duration and you will terms of the mortgage), since this error perform bring about their unique so you’re able to be eligible for a significantly more expensive financing.

If you obtained loan forgiveness because of your provider-linked handicap, your credit score ought not to claim that you still owe the fresh debt. Almost every other borrowers which discovered an impairment release is tracked for a few age by Service out-of Degree. But when you received a release considering Va documents, you don’t have to worry about this action as well as your borrowing from the bank declaration is reveal that so long as are obligated to pay the mortgage, not that it actually was assigned to regulators getting monitoring. And remember, you can check your credit score free-of-charge.

We continue to listen to regarding veterans and you may servicemembers about the unique servicing barriers they deal with as they attempt to pay pupil mortgage obligations

Very federal money applied for prior to 2010 finance essentially created by financial institutions or other personal organizations however, secured by the government want your own lender to help you change what on the credit file immediately following the loan could have been released. Though no the fresh money bad credit loans in Oakland was given less than this method, you may still find millions of individuals paying such mortgage. Pros who have discharged these money shall be certain to look at their credit file continuously, just like the statutes out of impairment launch altered inside 2013.

Last year, we set organizations into note that they have to check out the disputed recommendations when you look at the a credit report, and this we’re going to bring compatible step, as needed

Focusing on how released fund show up on your credit history can be become complicated. For those who file a conflict and it nonetheless doesn’t get remedied, fill in a grievance around and we’ll work to enable you to get a reply throughout the organization. You can call us at the (855) 411-2372 or complete a grievance on the internet.

We’re going to also continue steadily to closely screen complaints away from pros and you can most other handicapped education loan consumers to make certain student loan servicers is decorating best pointers toward credit reporting agencies regarding handicap discharges. The economic properties team one to suffice experts would be to redouble its work so experts are not penalized getting choosing the huge benefits they won and you will deserve because of their sacrifices.

Holly Petraeus is Secretary Movie director of your Work environment of Servicemember Factors and you will Rohit Chopra ‘s the CFPB’s Education loan Ombudsman.

Scrivi un commento