For some, a hurdle to buying a property are sensible capital. A couple of government financing applications produces a positive change for those whom meet the requirements.

Virtual assistant and you will USDA home loans is actually money-savers one to charge couple charge, get rid of the cost of home loan insurance policies, require no deposit and you will funds 100% of the residence’s rates. Its not all debtor or property is eligible for either financing, however homeowners be eligible for one another. Very, you will need to know the positives and negatives getting Va fund and you will USDA funds.

Exactly what are Va Funds?

Virtual assistant loans is authorities (also referred to as low-conforming) loans paid by U.S. Department out of Experts Issues and are limited to army experts and their spouses. Personal lenders supply the investment, however the Va guarantees your debt into the lenders if the borrower default, therefore loan providers can offer best terms than just old-fashioned mortgages.

Va funds enjoys several advantages. There are no restrictions toward money, credit history otherwise mortgage quantity getting consumers, as the bank should determine exactly how much you might use centered in your earnings, assets and you will credit rating. As opposed to USDA finance, there are no venue constraints. You could only have you to Virtual assistant mortgage at once, but there is however no restriction towards number of such funds you are able to take-out inside your life.

Just what are USDA Funds?

Instance Virtual assistant financing, USDA financing are bodies-backed. Though there is actually income constraints, experienced reputation will not affect exactly who may apply. An important limitations come into where they’re made use of. These loans appear just for attributes the USDA enjoys designated because rural components.

USDA funds can be used to build, repair, remodel land otherwise pick and you may prepare house internet, also liquid and sewage assistance that will be usual during the outlying locations.

Loan Qualifications Criteria

Va finance are only designed for pros that have came across provider length criteria. Which relates to active-duty provider people also anyone who has honorably exited this service membership, also particular Reservists and you can National Protect members and lots of enduring spouses out-of deceased veterans.

The funds certification to own USDA loans are different by state and also by county. Among parameters are domestic size, the number of owners below 18 years old, if or not all candidates try 62 or elderly assuming any disabled people are residing in the family. The latest USDA Outlying Development site has a qualification setting which means you are able to see for people who be considered.

Assets Conditions

USDA finance can be used for no. 1 homes, perhaps not trips belongings, facilities, rental otherwise capital functions. Virtual assistant finance will let you pick up to a four-unit possessions. If you explore some of those units as the good first quarters, you might rent out the rest.

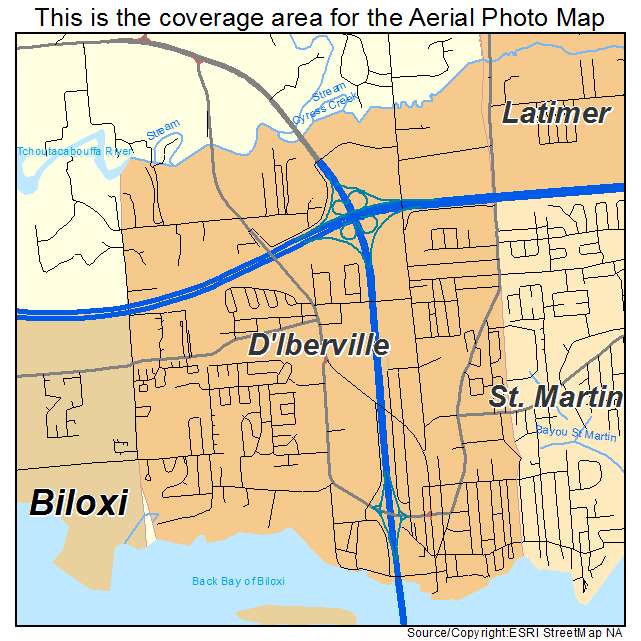

And the USDA concept of rural was generous. Of numerous components only exterior urban centers, and additionally of a lot urban centers and you may brief towns and cities, qualify. The fresh new USDA web site enjoys a chart that displays if areas are qualified or ineligible to have USDA money, together with vast majority of the country is approved.

Brand new Va necessitates that a property end up being inspected and satisfy minimum property requirements for a financial loan are accepted. New examination boasts making certain heating expertise and you can roofing try adequate, there are not any leakage inside the basement and you will spider spaces, technical expertise can be work securely as there are no lead area.

Mortgage Limitations

The fresh USDA sets no limits exactly how much you can acquire to your Unmarried Family relations Guaranteed Financing, which is the most frequent USDA loan, but discover money constraints. Given that 2020, a comparable holds true for Va fund if you have complete entitlement. Pros possess entitlement if one of your after the holds true:

Scrivi un commento