Choosing a mortgage will be difficult for a few people. They’d have to make a large ics of the financial state consistently. It is because of one’s EMIs they’ll certainly be investing every month. It will naturally affect their month-to-month spending plans. Bringing recognized to have a home loan will be easy as long since you fit all the qualifications requirements lay by the economic place of your preference. Good credit and you can a clean credit score will even help you on your journey to a fast recognition. It is usually better to familiarize yourself with several guidance towards how to get effortless acceptance to have a mortgage.

Suggestion #1: Look after good credit

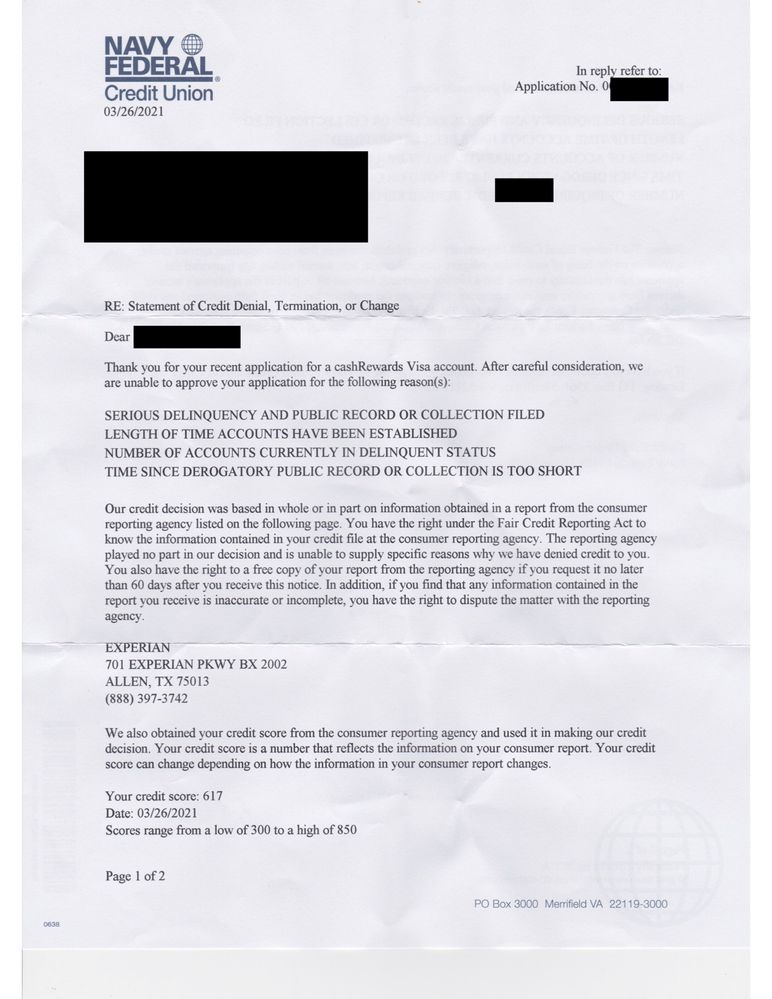

Some people might not envision checking the credit scores before deciding getting a mortgage so long as he is inside the a good credit score health. Nevertheless when you are looking at the main point where the credit rating and you will credit rating is actually lower than analysis and in case it is not up towards the mark, they’ll be facing rejections out of loan providers.

A credit rating are often impact the decision regarding whether or not you’ll become approved to own a mortgage or perhaps not. That have good credit often imply into the loan providers one to you can easily manage a mortgage if you are paying their month-to-month EMIs regularly. Your credit rating would be a representation of your own credit rating. Your credit score include information on all prior credit you have come approaching. Information regarding if or not you’ve been purchasing their a fantastic expenses on your credit cards continuously or around the latest texture with the settling the latest earlier in the day loans that you’ve borrowed. The ultimate credit history will provide the lender a guarantee one to possible handle home financing. You’re getting your financial approved with no issue.

There is discrepancies on your own credit score that may connect with your odds of bringing a mortgage. Checking your credit history to own mistakes and you will fixing them right that one can are forthcoming. You would not want a number of problems in your credit rating to help you hinder how you’re progressing when trying to obtain home financing. For people who haven’t paid down their prior expense, which can definitely be on your credit score. Therefore in advance of considering applying for a home loan, you need to reduce all expenses.

Suggestion #2: Stand Operating and then have a steady Earnings

In the event the lender do a background check up on you, they shall be exploring your existing a position and you can earnings too. If you are not employed today and you have removed home financing, that wont sit better towards the loan providers. They might obviously doubt the brand new stability from how you would carry out to pay the EMIs with no employment help your. Loan providers are often place an eligibility requirement from minimal income the latest applicant can be generating. If you complement the new requirements, you can easily become approved to have home financing.

Suggestion #3:Prevent Taking The fresh new Credit and you may Accept Dated Debts

Taking the fresh new borrowing, such as, a personal loan, during choosing a mortgage isnt a great good idea. It is because this may result in a hard inquiry. Tough enquiries are https://paydayloanalabama.com/rock-mills/ built when a loan provider is actually evaluating your credit as you are trying to get another borrowing from the bank together. When a difficult query is created you, your credit rating will shed. It doesn’t look good on your credit history and when it becomes assessed because of the lenders who will be responsible for approving your residence mortgage, that it tough enquiry may get in the manner. And additionally, approaching their mortgage repayments and your unsecured loan at the same day is not smart. Double EMI money usually weigh you off, giving treatment for a debt trap.

Scrivi un commento