The fresh new Washington State CDA try an excellent HUD Recognized Construction Agencies taking Homebuyer Informing, Homebuyer Knowledge, and for those who qualify for an advance payment Direction system. All of our Homebuyer Telling and you may Knowledge applications are capable of those appearing for taking the home to get diving into the earliest-day, or for veteran people seeking to brush up on new inches and outs of the home to order techniques.

Homebuyer Degree

Brand new CDA offers Homebuyer Training 1 of 2 indicates privately or on line. Homebuyer Studies is a fantastic followup so you’re able to Homebuyer Telling visits. Homebuyer Education is needed from the lenders for some basic-day homebuyers while the an ailment of its mortgage and you will/otherwise down payment recommendations system recognition. Homebuyer Degree empowers homebuyers towards the experience in how process works and you may what to expect when purchasing a home.

In-individual, the fresh new CDA has the benefit of a home Expand Workshop, that is 7 days out-of homebuyer training provided by the new CDA into a monthly, either as the a most-big date seven-hr workshop or two-four-hr classes coached more than two day/night classes. Domestic Increase support players comprehend the home buying procedure and strategies. Players get a certification on end of your working area.

Observe a list of then workshops, and/or to register for a workshop online thru Eventbrite, delight click the link.

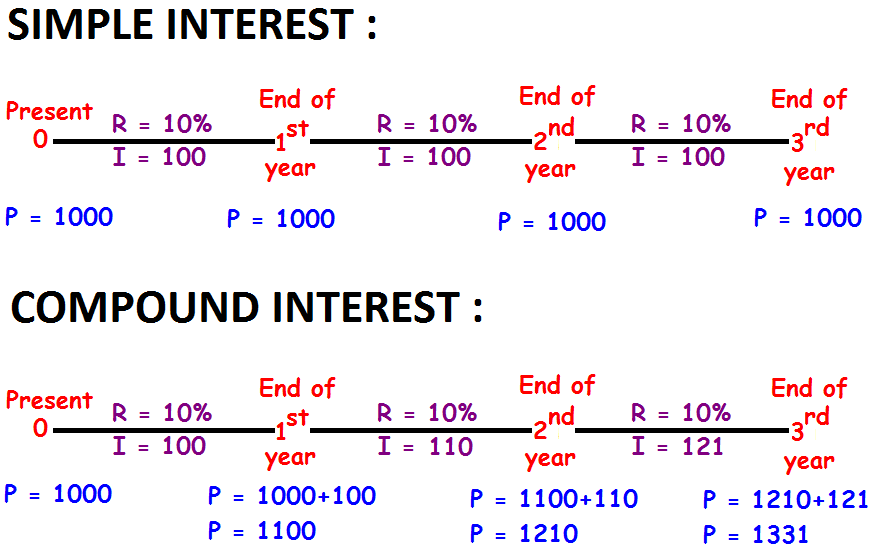

Subjects secured from the a home Increase Workshop tend to be are a house owner, homeowner money management, borrowing from the bank standards, mortgage credit and financing, real estate professional traditional, home evaluation evaluation, financing closure and you will community affairs. Really tutorial provides professional community volunteers (who happen to be low-biased rather than allowed to encourage in order to professionals) that help safeguards these types of subject areas and gives information on the local family customer sector criteria. The cost try $forty. If you like to spend that have bucks otherwise check or consult a charge waiver, please get in touch with our home ownership agencies in the CDA.

You need alot more independency than simply a call at-individual Domestic Offer Working area? Structure will bring an online house visitors knowledge path and this can be completed home otherwise on the move on your personal computer, pill if you don’t their mobile phone. Many people complete the coursework into the 4-six days. A few of the exact same topics was secured about during the-person classes as with the internet way. Recommendations provided thru Framework lies in federal analysis, so you may need certainly to talk with an effective homeownership loans Roanoke AL professional to possess a free of charge Homebuyer Informing meeting to determine how the pick process pertains to your. The price of Construction try $75 click on this link to learn more or even subscribe! (the CDA ework)

To prepare a totally free Homebuyer Informing appointment or consult a lot more details about any of the applications in the above list, please make use of the contact details below. We are HUD-approved property counseling service. Every Advising, and you will Education program properties are private.

Homebuyer Advising

The fresh CDA also provides Free Homebuyer Advising. Many people has actually questions regarding to order property. Just how much do i need to pay for? What credit score manage Now i need? What’s Sleeve, PITI, otherwise PMI? The citizen specialist makes it possible to get going about best guidelines.

In the meeting, new citizen professional commonly remove your credit score for free and you can opinion it to you whenever expected, give you the units to completely clean it and you may replace your fico scores. The fresh citizen specialist commonly remark some other home loan programs and you will your regional or county deposit/closing costs guidance software that you may possibly be eligible for. They will make it easier to figure out what you really can afford, just how to cover your brand-new domestic and build a post fulfilling action plan which information the necessary steps so you can see your financial desires.

Delight respond to the questions and you will signal the disclosures because provided on line. Because the consumption setting was received, some one usually get in touch with one to developed a consultation to talk regarding the state and you can advise you of every facts otherwise papers that will be needed. If you need let finishing the proper execution, you can name new homeownership group on 651-202-2822 or elizabeth-post [email secure] having guidance.

Seeking information regarding homebuyer guidance?

Call us within , or send us a contact making use of the contact switch lower than. A person in our very own homeownership teams have been around in reach having you soon to resolve any questions and get you the pointers you need.

Scrivi un commento