While caught with high personal debt-to-income proportion, you may find it difficult to qualify for a debt consolidation mortgage. Believe other ways to eliminate the issue, and combining because of a personal debt administration program.

Choice for Higher Debt-to-Income Ratio Loans

Debt consolidation are merging several costs to the you to large loans you to try reduced having a loan otherwise personal debt-relief system who’s got more good interest rates and a lower payment per month.

A debt settlement loan regarding banking companies, credit unions or on line debt consolidation reduction lenders is the most preferred particular debt consolidating, but lenders is actually unwilling to provide currency so you’re able to people that have an excellent high obligations-to-earnings proportion (DTI).

People with high DTI are believed a severe exposure very even although you is actually acknowledged for a loan, the attention prices and you can monthly premiums will be excessive you to definitely it is far from useful.

It can be difficult to get a debt settlement financing from the the pace you like, however, there are ways within the problem. Other financial obligation-rescue possibilities, including a personal debt management program, may help you consolidate the debt without the need to remove a leading chance mortgage.

What is a high Personal debt-to-Earnings Ratio?

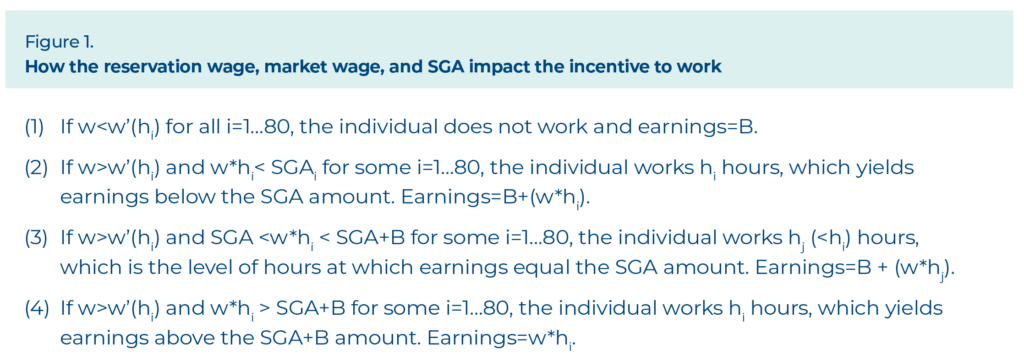

Debt-to-income (DTI) is actually a hack you to lenders use to measure exactly what part of your earnings visits paying down expenses and if there is going to be sufficient currency kept every month to repay a new mortgage.

The debt money ought to include costs for construction, utilities, car, beginner and private financing, alimony otherwise youngster payments and minimal count owed for the handmade cards. Earnings will be currency your found each week otherwise month-to-month that includes wages, tips, incentives, child payments, alimony and you may Societal Safeguards.

Should you the fresh mathematics, you are going to reach a portion. Thus, in case the loans repayments try $1,800 30 days and your money totals $4,000 a month, their DTI was forty-five% (1800 ? 4000 = .45).

Some thing more 43% is considered a top DTI. Acceptable DTIs include financial to financial, but generally this is the way they dysfunction:

0% in order to 36% – You are ready to go. You’ve got been shown to cope with your bank account during the a great in control ways.

37% to help you 43% – A little bit of a gray urban area. Nevertheless eligible for that loan, nevertheless interest rate was a little more than you’d like.

44% in order to 50% – Here is the highest-exposure group. If the a lender approves financing (particular wouldn’t), it will have an interest rate sufficient to relieve the brand new lender’s matter.

50% – Really loan providers commonly reject customers within group. There are less than perfect credit loan providers which may approve a loan, nonetheless it would-be within an elevated rate of interest that actually this new debtor would have to reconsider whether or not the guy/this woman is wearing anything from financing at this particular rate.

Solutions to own Highest Personal debt-to-Money Ratio?

The reality that you’ve got a top obligations-to-money proportion doesn’t mean you are never going to be eligible for a debt settlement loan. But not, it can mean that you will keeps work harder in order to see a loan provider happy to accept financing and it’s probably to provide a smaller-than-prominent rate of interest.

The brand new initial step shall be pinpointing businesses that markets poor credit funds, what are the classification your fall-in with a high personal debt-to-income proportion. A poor credit loan is made for people who have high DTIs and you can low fico scores.

Most of the companies giving poor credit funds are going to become on the web lenders and even though they might promote pricing since the reduced in the seven%, there is also a high end out-of 36%. Your loan is going to be a lot closer to thirty-six% as opposed 8%.

Avant most likely is best understood bad credit loan bank, but there are lots of locations to search up to as well as PeerForm, LendingClub and OneMain Financial. Its really worth time to inquire of a local financial, for those who have a relationship around or a card connection, which has significantly more independency into the decision-making on the money.

To get rid of getting declined having a bad credit loan, is actually trying to find someone with excellent borrowing from the bank to co-indication the borrowed funds along with you. The borrowed funds terminology would mirror the fresh co-signer’s credit history that assist reduce the interest you pay.

For people who own a home, a different would-be experiencing the collateral you’ve oriented around. You to indeed perform create the reasonable interest rate, but inaddition it puts your house at risk of foreclosures if you do not generate payments. Look at this a last-ditch choice.

How to Reduce your DTI

This is basically the method you want to go-down if you are seeking alter your financial situation. Here are some things you can do to reduce the DTI while making yourself a more attractive applicant for a loan.

- Pay-off funds very early. Decreasing the amount of debt you have got is the quickest method to alter your own DTI.

- Raise earnings. Selecting a second employment or providing a marketing having a growth in the shell out ‘s the next fastest action into improving your DTI. More money means much more possible opportunity to lower personal debt, for example an improved DTI. Front hustles abound online nowadays.

- Beat purchasing. Things such as eating at restaurants, looking for clothing, and you can activity paying increase your debt. Place all of them to the hold and invest more of your income so you can cutting, upcoming eliminating personal debt.

- Credit report. New Federal Exchange Fee states forty billion individuals have problems for the the credit history one negatively perception credit scores and DTI. Have you been among the 40 million?

- Balance import credit. This can be a whole longshot because you you would like a credit score away from 680 or more discover a great 0% balance import credit. But when you be considered, bring it and implement normally of your income since you is also to help you cleaning aside personal credit card debt entirely.

- Re-finance fund. If you re-finance loans of the website link extending the new commission minutes, it will decrease your monthly financial obligation payment and this enhance your DTI. However, this is the least trendy means available. It have you with debt stretched while shell out alot more desire.

Higher Personal debt-to-Money Ratio Not a buffer so you can Nonprofit Consolidation

Whenever you are not able to get a debt consolidation mortgage due to the fact out-of large loans-to-earnings ratio, think a separate version of consolidation that doesn’t wanted a loan – a financial obligation government package.

InCharge Debt Options consolidates your own credit card debt playing with a debt administration plan maybe not financing – to pay off your debt. Qualifications is not according to a credit score, but alternatively your capability to settle the debt.

A debt administration bundle decreases the interest on your own credit credit debt so you can somewhere around 8%pare that on the 30%-36% pricing you are using towards a debt settlement mortgage.

InCharge borrowing from the bank advisors manage credit card companies to get at an inexpensive payment per month one to does away with financial obligation inside step 3-5 years, or around a similar repayment time for debt consolidation reduction fund.

Scrivi un commento