The benefit isn’t as huge as others with this listing, but which financial promotion was advisable for many who don’t want to fulfill a primary deposit requirements to make a good bucks award. Unlike very bank incentive also offers about this checklist, the fresh Chase Safer Banking extra doesn’t require lead put. Rather, you’ll need meet the absolute minimum number of qualifying purchases such while the debit credit requests and you will Zelle transfers, however’ll has 60 days in order to meet the necessity. It bonus offer makes you secure a profit extra that have the selection of both a new integration checking-and-checking account otherwise a different savings account just.

The length of time Will it Take To own Covered Money As Offered When the A lender Goes wrong?

We think people will be able to make economic choices which have confidence. If your Computer game or other deposit account was at a credit partnership, you have made a similar type of $250,one hundred thousand insurance policies if it’s a part of one’s National Association away from Credit Unions (NCUA). The brand new FDIC try an independent federal service that was created in 1933 to support balance on the financial system. If the a lender goes wrong, the new department will pay depositors with funds from the fresh Put Insurance coverage Finance (DIF), that their member associations contribute. Financial failures tend to be less frequent since the FDIC been process within the 1934. Ahead of one to, a huge number of banking institutions hit a brick wall inside the Higher Depression—4,000 in the 1933 by yourself.

Subscribe now let’s talk about 100 percent free use of the content

Browse the campaign information more than to know all the regulations and you may conditions to make the fresh savings account bonus, as well as an excellent high minimum import count that may never be sensible. The best bank campaigns offer the possibility to earn a serious cash bonus to own joining a different account without charges or charge which can be easy to rating waived. An informed financial bonuses for your requirements try of them which have requirements you are more comfortable with, like the period of time you will need to keep the money regarding the membership to make the bonus.

When the Government Set-aside decreases the put aside ratio, they lowers the level of cash you to financial institutions must control supplies, permitting them to create far more financing to help you users and you can businesses. Nevertheless enhanced investing activity can be in addition to try to boost rising prices. Even if just $250,one hundred thousand try insured, you’re not gonna get rid of 750,one hundred thousand away from a million money deposit. In the event the those individuals money is actually 90% of one’s dumps then lender is during strong problems, but you however get 90% of your uninsured money back. I then found out there is something called CDARS enabling a individual unlock a great multiple-million buck certificate from put account having an individual standard bank, who provides FDIC visibility for the whole membership. It lender develops the individuals currency around the several banks, in order that for each lender retains below $250K and will deliver the simple FDIC publicity.

Places ballooned from $62 billion to $198 billion more than that point, since the thousands of technology startups left their funds in the financial. Usually, clients are permitted to join borrowing unions considering where it live or functions. For those who have a joint account, the newest FDIC covers every person as much as $250,100. You can have one another mutual and you may single membership at the same lender and become insured per.

Greatest on line financial institutions one to bring dollars dumps

Open a normal Family savings having the absolute minimum starting put out of $25 on the offer page. Even though you got more than the newest $250,100000 restriction deposited, you do not lose all of your financing. A good example of this is observed in the newest failure of Earliest Republic Lender and its particular subsequent buy vogueplay.com visit our web site because of the JP Morgan Chase in-may of 2023. Or even, the government will get defense the remainder of your fund, because it accessible to create after the Trademark Financial and Silicone polymer Area Lender downfalls. Eventually, all buyers property was secure when Flagstar Bank grabbed more Signature Financial, and First Owners Financial & Faith Co. grabbed more than Silicon Valley Financial. Instead, those funds try borrowed out over some other clients otherwise accustomed commit.

- •What number of pots recycled through the pilot program 30 days puts SF BottleBank at the end step 1% of all the recycling cleanup locations regarding the condition.

- Pros whom secure info, for example bartenders, servers and hair stylists, will get frequently need deposit bucks.

- Here are a few of the reviews is basically contrasts anywhere between him or her commission tips.

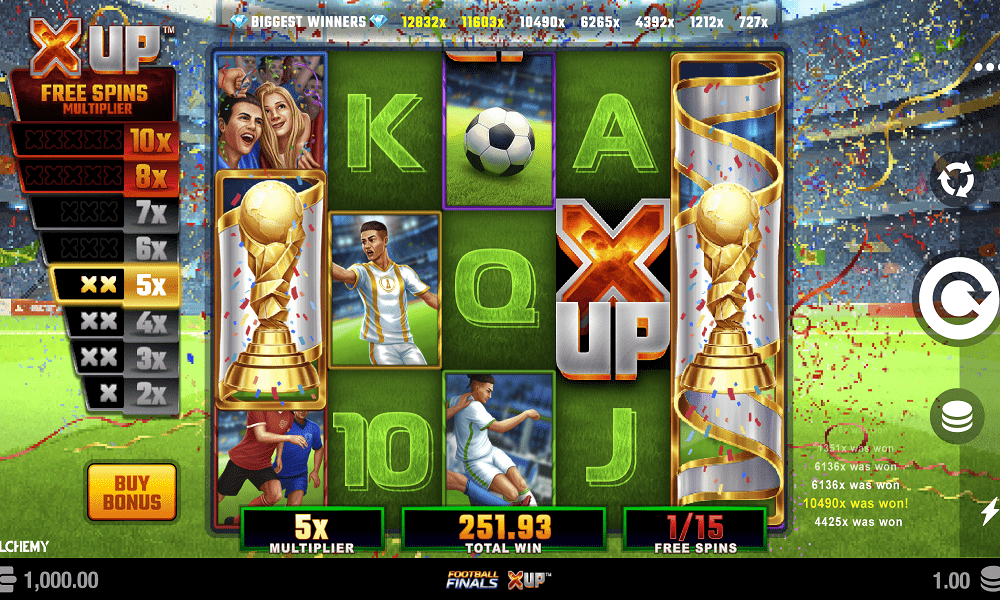

- Microgaming video game is actually look the same now, he has an exact same algorithm due to their ports.

- You can look on the FDIC symbolization at the lender teller screen or to the entry on the bank department.

A random sampling from affiliate businesses has the fresh brokerage divisions away from the big financial institutions, and independents for example Edward Jones, PWL Money and you will Raymond James and you will digital agents such as Questrade and you will Wealthsimple Investments. Any public otherwise sweepstakes gambling enterprise from your shortlist offers a good $1 acceptance extra. All of the on-line casino i remark pursue so it so we can be make sure i render reasonable and you may reliable recommendations for all of our players. Which antique games from PlayTech notices you twist the newest reels with a great cuddly panda buddy and you will against an attractive flannel career background. Merely property six or even more ‘Happy Coins’ in the online game in order to trigger a lucrative 100 percent free spins bullet. And make an excellent $step one deposit during the an online social local casino is straightforward and simple doing.

There have been 21 broker insolvencies since the CIPF is formed in the 1969, the newest as being the 2015 death out of Octagon Funding. Based on its current yearly declaration, the newest finance had $step 1.1-billion available to deploy in the a keen insolvency from the mix of a broad financing purchased regulators securities, personal lines of credit and you will insurance policies. Just as CDIC are funded by the banking companies, CIPF are financed by the the players – funding organizations and you will common fund traders.

Credit Suisse are undone by many people items, but just at the top of record are a couple of nasty, brutish and you can short periods of deposit flight. The fresh Swiss lender scrambled to manage the new drop out whenever clients withdrew SFr84 billion ($94.3 billion) history October. “As i dug greater, they explained that account is flagged to have fraudulent activity and encountered the directly to intimate my personal account without notice and instead of explanation,” it additional.

One another checking profile offer consumers usage of more than 100,000 surcharge-100 percent free ATMs and need simply $twenty five to start. OneUnited also provides an automatic discounts function, which you can use ranging from OneUnited membership or with an external linked bank account. The newest device rounds right up for every deal and you will moves the other transform to a checking account. Consumers that have a good OneUnited checking account is actually instantly signed up for the financial institution’s early head put element, BankBlack Very early Spend, immediately after choosing one to two personally transferred paychecks. OneUnited Bank ‘s the first Black-possessed online bank as well as the premier Black colored-had financial in the U.S.

You to stop worry certainly one of consumers, just who withdrew their money inside signifigant amounts. Whenever interest levels rise, thread prices fall, and so the dive inside the prices eroded the value of SVB’s bond profile. The brand new portfolio is producing an average 1.79% go back a week ago, far below the 10-season Treasury yield of approximately step 3.9%, Reuters claimed.

The united states internet casino to your better $step 1 deposit incentive is actually Hello Millions. Listed below are some all of our shortlist to see our bullet-upwards of the greatest $1 deposit personal gambling enterprises in the usa. The usa internet casino to the lowest lowest put is Hello Many. Boost your money on the finest $step one deposit web based casinos in america.